The State of the Insurance Market 2021 (PDF)

2020 will forever be remembered as the Year of the Pandemic. It is unlike anything that has ever happened in my lifetime, and unfortunately the deleterious effects will be felt into 2021 and beyond. While some businesses and industries have been impacted more than others, every business has had to adapt. Companies are now looking into 2021 and putting together business plans and budgets. A major line item is insurance. It is not uncommon for a company to spend 3-6% or more of their total revenue on property and casualty and employee benefits insurance. The purpose of this newsletter is to give you an idea of what you can expect to see when your program renews in 2021.

The economics of the insurance industry

Insurance companies basically make money in one of two ways:

- Underwriting income

- Investment income

Money is made on underwriting when premiums received exceed losses and expenses. The metric to determine whether an insurer makes or loses money on underwriting is called the combined ratio.

Losses + Expenses / Premiums

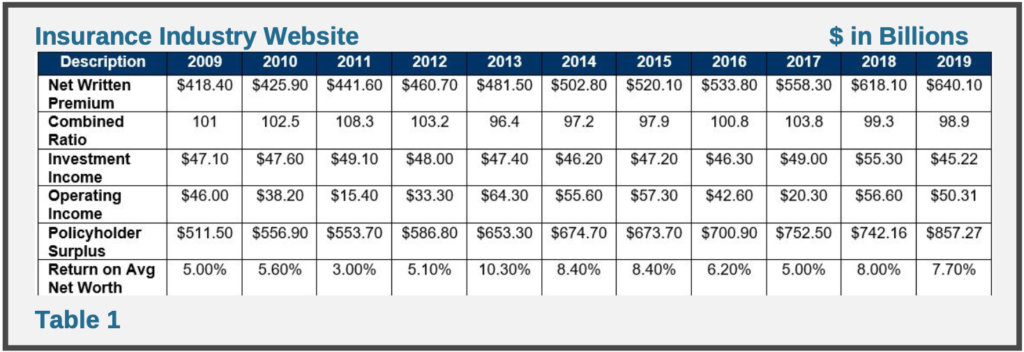

If the combined ratio is above 100%, then the company lost money. If it is under 100% the company made money. The industry has only had an underwriting profit 5 of the last 10 years averaging 101% or a 1% underwriting loss (Table 1).

Insurance companies also make money on investment income. This is income earned on policyholder surplus (money the insurance company has in the bank or has set aside to pay future claims). Surplus has grown over 50% since 2010, and finished at an all-time high of $847.8 billion in 2019. During times of significant investment income, insurers are willing to take less of an underwriting profit, or even live with an underwriting loss, if it is offset by significant investment returns.

The insurance industry also has its own unique business cycle. When insurance companies are generating a decent return on average net worth, whether through underwriting income, investment returns or both, the market is competitive. Underwriters relax their underwriting standards and tend to lower their premiums in order to either retain existing business or acquire new business. This is known in the industry as a soft market. Ultimately, as results of the soft market negatively affect the industry’s profitability and surplus, underwriters have to react. This results in decreased capacity, caused by decreased surplus, increased underwriting scrutiny and increased pricing. This is referred to as a hard market.

It is also important to point out that insurance is a “supply driven” industry. The more surplus it has, the more business it can write. As mentioned above, at the start of the year surplus was at an all-time high and had been growing every year since 2011. This streak now appears to be in jeopardy. As of March 31, 2020, surplus actually dropped $75.9 million to $771.9 million. This is a major concern for the industry.

Where are we now?

After years of decreased rates, pricing started increasing in 2019. The reason for the increased pricing had to do with deteriorating underwriting results, poor investment returns (the industry is restricted in what it can invest in and the significant drop in interest rates has destroyed the industry’s returns) and social inflation (higher jury verdicts)…then COVID-19 hit.

The direct costs arising out of the pandemic and the uncertainty surrounding the ultimate costs have made a bad situation worse. The industry is now clearly in a hard market cycle. One well known industry study revealed an acceleration in U.S. composite pricing by an average of +18%. This, however, is not consistent across all lines of coverage. Renewal rates will vary by line, as well as by individual account.

What can you expect in 2021?

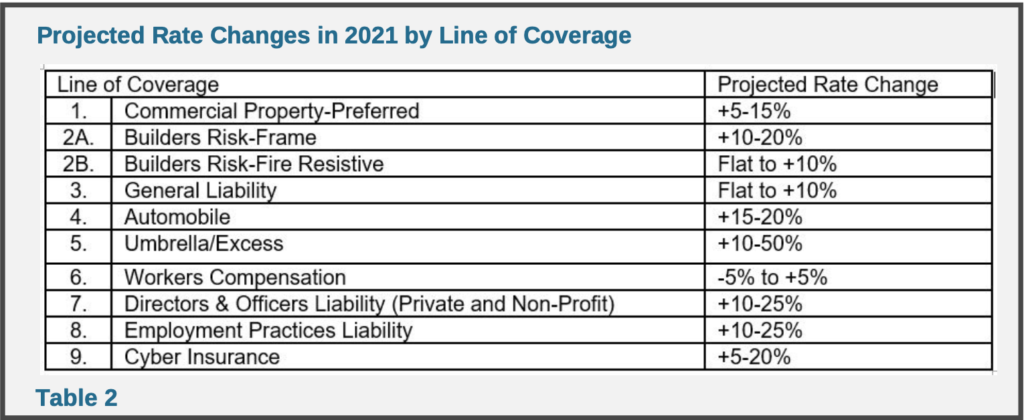

Rate changes on individual accounts (risks) will be affected by the industry, where the business is located, as well as the individual characteristics of each risk. Well managed companies with thoughtful safety, human resources, and claims management procedures as well as lower losses will receive preferred pricing. Poorer run companies with mediocre controls and below average loss ratios will pay more. Below are our projections on what you might expect based on line of coverage. Note that these are based on an average risk with a decent loss ratio. (Table 2)

1. Commercial Property – while property rates in general are trending up, certain risks are going up dramatically. Preferred properties in protected locations with decent loss histories can expect increases in the 5-15% range. Properties in wind driven areas or in close proximity to open land (wildfire exposed) may see rates go up 20-40% or higher. Capacity is shrinking and retentions are increasing. Larger placements are requiring layered programs in many instances.

2. Builders Risk – similar to property in general, Builders Risk rates are trending up.

- Frame projects are the biggest challenge. Capacity has been dramatically curtailed and larger placements are shared amongst various insurance companies. Deductibles are increasing. On any proposed project, but especially frame projects, you will want to lock down your pricing as early as possible. Location also plays a major factor.

- Non-frame construction such as concrete or other fire resistive structures are seeing increases, but nothing close to what we are seeing on frame construction. While capacity is declining and retentions may be increasing, you can expect rates to be either flat or increase 5-10%.

3. General Liability – rate increases are predicted to be modest. Most underwriters would like to get 5-10%, however this line remains fairly competitive and average rate increases should range from 0-10% for preferred risks. Don’t be surprised however if you see higher retentions.

4. Automobile – remains a problem. Combined ratios have been over 100% for years and it doesn’t appear to be getting any better. Up until COVID-19, miles driven were increasing which increases actual exposure. COVID-19 has reduced this exposure but it is viewed as a blip and not permanent. Loss frequency per miles driven continues to escalate due to a number of factors but mainly distracted driving. At the same time, severity is increasing. The cost to fix a late model car is more expensive today due to cameras and sensors, medical costs are increasing, and social inflation is driving up jury awards. Auto in general will go up 15-20% in 2021.

5. Umbrella and Excess Liability– pricing is increasing significantly and capacity is being cut. While on average we are seeing rate increases of 25% to 100%, we have seen increases higher than this. In addition, many underwriters are reducing the limits they are willing to offer. There are several reasons for this but the main one is increased jury awards, also known as social inflation. This has increased in both frequency and severity. Businesses considered high risk include hospitality, shopping malls, and certain construction operations. If you have a significant excess tower to renew it is recommended you start early and seek commitments from your incumbent underwriters.

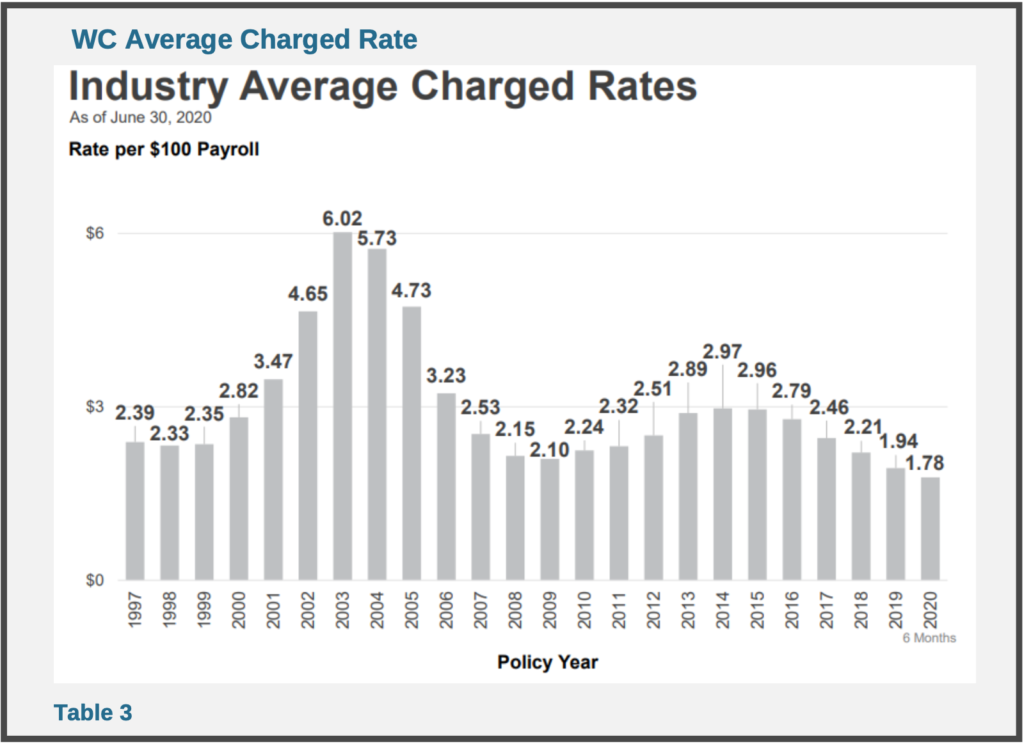

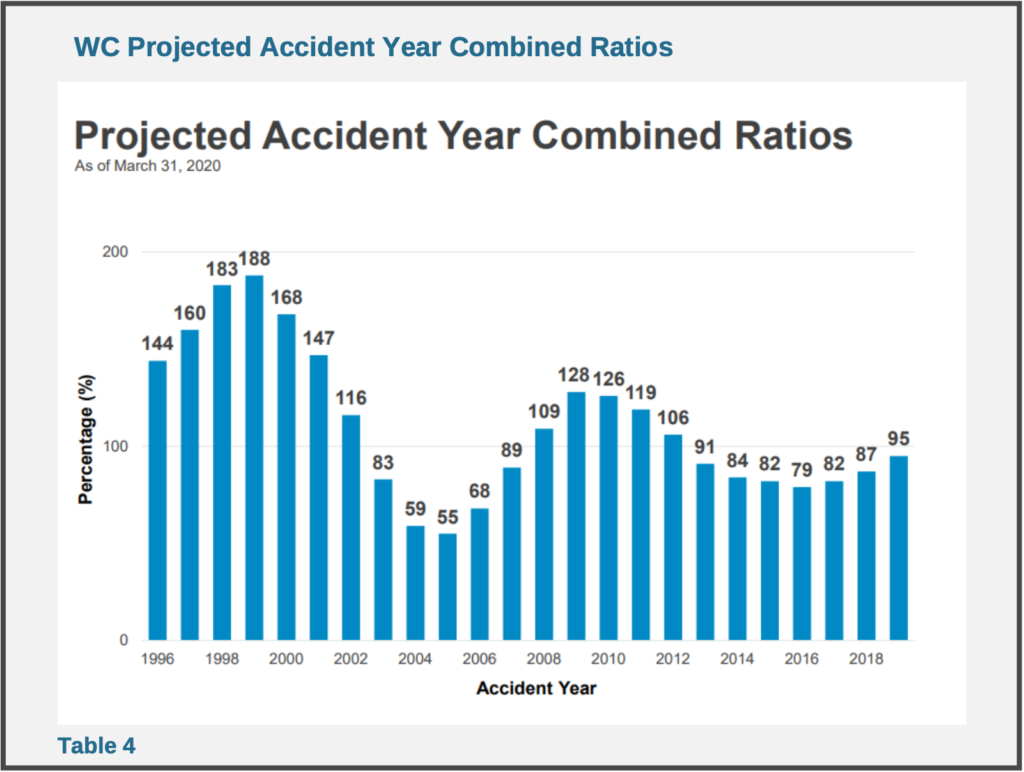

6. Workers Compensation – remains competitive, but for how long remains to be seen. In California, “Industry Average Charged Rates” (Table 3) have been declining since 2014. Since then they have dropped 40% and are the lowest they have been in 20 years. Combined ratios however, are trending up. If you look at Table 3 you will note that since 2016 the combined ratio has increased from 79% to 95% and this does not include the impact that COVID-19 related claims will have on the industry. While we anticipate consistent rates in early 2021, we do expect workers compensation to start increasing not only in California but nationwide, as early as the latter half of 2021 and certainly into 2022. (Tables 3 and 4)

7. Directors & Officers Liability – the devastation of our economy and the poor results of many companies resulting from that, has caused turmoil in the D&O marketplace, especially for publicly traded companies. Expect 15-40% increases for non-profits and privately held companies and 25-100% for publicly traded companies.

8. Employment Practices Liability – is also affected by our current economy. The sheer number of people that have and will lose their jobs is causing employment related claims to spike. You can expect 10-50% increases along with increased retentions, especially in California.

9. Cyber Insurance – remains competitive. While we are starting to see more claims activity, resultant premium increases have been fairly modest. We still expect rate increases in the 5- 20% range.

Final Comments – The commercial insurance industry is in a hard market cycle. Rates are going up, capacity is decreasing, more stringent terms are being imposed, and underwriters are spending more time evaluating risks. In times like this, accounts are marketed more frequently and insurance companies will be inundated with submissions. We don’t recommend you market every year. Insurance companies value long- term relationships, and if you are perceived purely as a price shopper, you won’t get their attention when you need it. So how should you handle your renewal this year?

- Align yourself with the right broker. Your broker should be the quarterback not only of your insurance coverage, but your marketing efforts and coordinating your risk control strategies.

- Evaluate your past marketing efforts and determine if it makes sense to obtain early terms from your incumbent insurers or go out to market.

- If you elect to go out to market, get out there early.

- Make certain you work with your broker to provide a complete submission that explains why you are an excellent risk and worthy of the credits that the underwriter has to give.

- When evaluating an insurance company, you should consider the coverage offered, the company’s claims handling reputation, and the assistance they can provide from a risk control standpoint. Premiums are a key factor as well, but insurance is like a lot of things, you generally get what you pay for.

Insurance is only one component of the total cost of risk. When you factor in money spent on deductibles, uninsured losses, safety programs, training and other things, this cost adds up. While shopping around for the cheapest premium is one way to lower this expense, the only way to lower the cost in the long run is to lower the frequency and severity of the claims that drive the cost. Investments in risk control usually pay huge dividends!

Surety market outlook for 2021

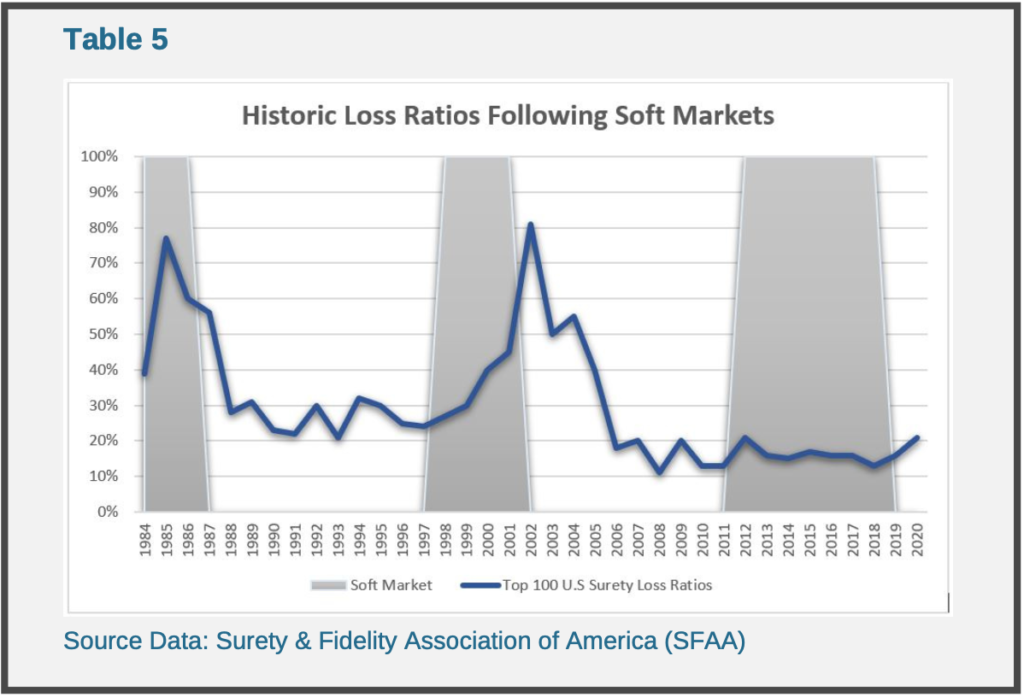

Entering 2020, the overall surety market had been experiencing the longest expansionary period in history; with direct written premium growth of nearly $2B since 2012. This record expansion resulted in very relaxed underwriting guidelines, new companies entering the bonding arena, and ultimately a significant surplus of credit. Now as we near the end of 2020, the impact of the current economic uncertainty has begun to surface. It is anticipated that the construction and surety markets will continue to see signs of stress through 2021 and likely into 2022. Economic cycles affect bonding more than any other insurance sector. When the overall economy is doing well, surety loss ratios are low and credit becomes more available and relaxed. Conversely, when the economy experiences a downturn, loss ratios increase and credit becomes scarce along with tightening underwriting terms and conditions. (Table 5)

Typically, the surety industry doesn’t experience losses for the 18-24 months after an economic boom, when contractors have worked off healthy backlogs. Unfortunately, under the current unprecedented economic conditions, it is harder to predict the next economic downturn. Contractors and sureties could experience losses much more quickly than we’ve seen in past cycles. The success of most contractors in the future will be dictated by the strength of their backlogs, management teams, balance sheet, and their ability to obtain and manage credit (i.e. Surety, bank lines of credit, SBA or other term loans, project payment schedules, etc.) With baby-boomer owners facing another economic cycle and a continuous push for heavy technology investments, we will likely see a further tick-up in mergers and acquisitions of contractors in 2021 as the construction landscape continues to evolve.

Health insurance outlook for 2021

In 2020 we saw an average of 4% increases in medical insurance rates. The impact of COVID- 19 is yet to be known, but most carriers are reporting lower annual claims. All non-essential care was postponed during the pandemic. That care will likely be completed in the near future and claims costs will undoubtedly increase. The Kaiser Family Foundation 2020 Survey is reporting the average cost for single coverage is $7,470 and family coverage is $21,342 per year. The average cost has increased 22% over the last 5 years and 55% over the last 10.

The 2020 election and Supreme Court confirmation could affect medical insurance in 2021. The Supreme Court is scheduled to hear a case that could make the Affordable Care Act (ACA) invalid. The ACA has been the law for 10 years and the federal government, the state exchanges, and all insurance carriers are complying with its rules. To unwind the ACA and start over will take years, so we do not expect this to impact health care costs in 2021. Health care will also be impacted by who wins the presidential election. We could see a move toward socialized medical care but regardless, these programs would take years to design and implement and will not change our 2021 outlook.

2021 will be like the last few years. Each of us will be one year older in 2021, which means our rates will automatically increase. For 2021, we expect low single-digit rate increases and minimal plan changes. Rates for all “small” employers (2-99 eligible employees) will be based on the employee and their dependents’ individual ages, plan design, and location of the company. For example, a family of five will pay for each family member based on everyone’s age and the plan they select.

For employers with 100 plus employees, the rates are expected to increase between 5-10%.

We forecast additional plan changes in 2021 that will remain compliant with ACA guidelines. All the major insurance companies have determined that, to stay in compliance with the ACA’s metallic tier guidelines, they must change plan benefits every year. Using the Platinum Plan as an example, if the actuarial value of a plan this year was $1,000, then the Platinum Plan must cover 90% ($900) and pass 10% ($100) to the plan member. In the second year, if the actuarial value goes up to $1,100, 10% ($110) can be passed to the plan member. This will always be a moving target until the values are fixed or the law is changed.

For insurance carriers to be competitive in 2021, they will continue to have plans that offer Skinny Network choices, which offer a smaller number of providers. Skinny Network plans might offer an attractive price, but employees will have a limited choice of doctors. Be sure to run a report to compare current providers to those associated with any programs you are considering. Insurance carriers continue to seek greater discounts from hospitals, medical groups and doctors, offering patient exclusivity in return. Some insurance carriers will allow Skinny Networks to be offered side-by-side with full networks, with the price and contribution being set by the employer to favor one or the other.

Employee satisfaction increases with choice of medical plans and networks, so the more choices offered, the better the employees feel about their benefits package. Also, ancillary (Dental, Life, Disability and Vision) and supplemental (Accident, Cancer, Hospital, etc.) benefits have shown to greatly improve employee satisfaction, which will help your organization hire and retain the best employees.

Captives, self-funding, and partially self-funded plans continue to be popular and could be a viable option for companies with over 50 employees. Additional ways to reduce cost include buying a Bronze Level Plan and supplementing it with Cancer, Hospital, Accident, and Critical Illness plans.

The following material is provided for informational purposes only. Before taking any action that could have legal or other important consequences, speak with qualified legal and insurance professionals who can provide guidance that considers your own unique circumstances, including applicable employment laws.