A partner through it all.

Founded on knowledge, driven by relationships, inspired by community.

At Cavignac, our vision is a community where every business is protected from risk.

We give confidence and clarity to companies like yours by providing knowledge-based risk management solutions and an exceptional client experience.

Our team of risk advisors are experts who eat, sleep, and breathe insurance.

We donate, volunteer, and collaborate to make our community a better place to live and work.

We build lasting client relationships on a level of integrity you simply won’t find anywhere else.

We are partners who always have your back.

We believe that the better we know your business, the better we can protect it from risk.

At the end of the day, we’re professionals committed to exceptional client experience.

Looking for a truly fulfilling career?

We've built the best team in the industry by empowering them to:

Belong

We emphasize culture and encourage collaboration. In our supportive work environment, you know your teammates have always got your back.

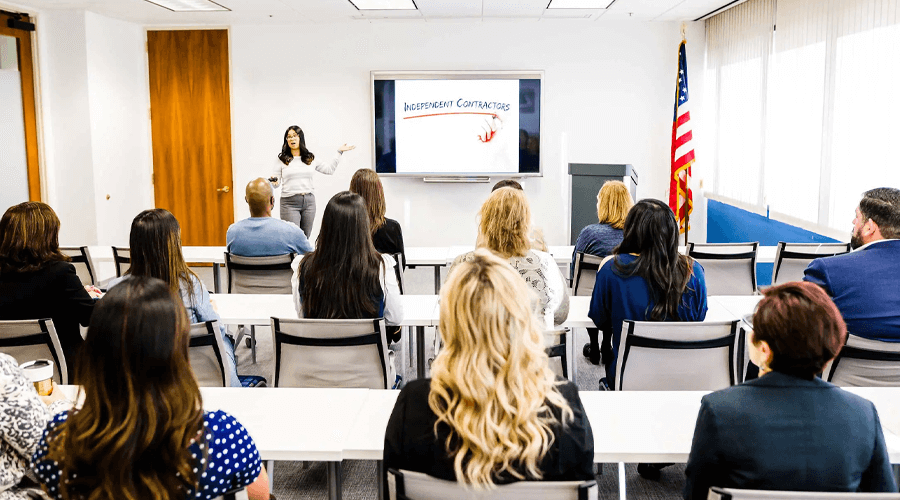

Grow

The only thing more important than our clients’ futures are those of our team. We invest 3x what other brokerages spend on education.

Give

We believe community is integral to a fulfilling career. We’re always looking for ways to give back to the place where we live and work.

Thrive

Comprehensive health, 401(k) matching, profit sharing, competitive PTO, generous bonuses, team events—we give our team the benefits they need to live their best lives.

Just ask our team.

Director of First Impressions

Varita Kirtley

Client Manager

“I’ve had the pleasure of working at Cavignac for 6 years. I cherish our respectful work place and the invaluable shared Agency bonus program. I’m grateful for the growth I’ve continued to experience and the opportunity for future growth.”

Sherri Irvin

Senior Client Manager

“After working at Cavignac for almost 5 years, it’s easy to see why they invest in their people. From supporting educational goals to personal development, it’s always about making the company better by making the people better.”

Dan Smith

Claims Risk Advisor

Anissa Stepp

Senior Client Manager

Dan Smith

Claims Risk Advisor

Director of First Impressions

Varita Kirtley

Client Manager

“I’ve had the pleasure of working at Cavignac for 6 years. I cherish our respectful work place and the invaluable shared Agency bonus program. I’m grateful for the growth I’ve continued to experience and the opportunity for future growth.”

Sherri Irvin

Senior Client Manager

Anissa Stepp

Senior Client Manager

Current Opportunities

- Play a vital role in the growth and perpetuation of a company.

- Become owners of a company that has developed a strong reputation in the industry.

- Create your Personal Excellence Plan with the Sales Manager and President.

- Identify, develop and nurture relationships with prospects and centers of influence.

- Leverage a system to maintain contact and add value to prospects, centers of influence and clients on a consistent basis.

- Deliver sales presentations to prospects and clients on new and renewal business.

- Adhere to Cavignac’s TotalRISK Approach sales process.

- Provide risk management/loss prevention advice to prospects and clients.

- Cross-sell the agency’s services.

- Ask for referrals from centers of influence and clients to generate new business.

- Participate in team sales situations with other Risk Advisors and support personnel.

- Proactively work on upcoming renewals to ensure services are completed in an accurate and timely manner.

- Assist in marketing accounts when having key relationships and/or product expertise.

- Review proposals prior to meeting with clients.

- Work with the team to design insurance plans and recommend coverages to clients.

- Document all material conversations in Epic with insureds and/or carriers regarding coverages and exposures.

- Maintain accurate client information while adhering to company SOPs.

- Resolve claim, billing and late premium problems while accurately documenting in Epic with service records (when required).

- Work with the team to ensure coverage adequacy and identify Cavignac resources needed to service client needs.

- Develop a profitable book of business for the agency and carriers.

- Execute the Personal Excellence Plan to ensure that the objectives are achieved.

- Take initiative for learning and improving technical and sales skills regularly.

- Attend and participate in sales meetings.

- Manage workload and relationships while consistently hitting monthly sales goals.

- Attend client related professional association events along with insurance association and company events.

- Understand and comply with agency SOPs, Customer Service Standards, and the Employee Handbook.

- Deliver presentations for professional associations, community events, partner webinars, etc.

- Join and participate in non-profit organizations throughout the community and sit on at least one Community Board.

- Maintain positive relationships with Cavignac employees and partners.

- Must hold and maintain current California Property & Casualty License.

- 4+ years experience as a Property & Casualty Risk Advisor (Preferred).

- Proven success record in achieving sales objectives and numbers.

- Attained a Bachelor’s Degree (Preferred).

- You lead through your actions and embrace your responsibilities.

- You’re a continuous learner who is always seeking to improve.

- You put the team first and create ways to make your peers better.

- You deliver an exceptional level of service to those you work with.

- You have strong interpersonal skills and thrive in a team environment.

- You’re an effective communicator; both written and verbal.

- You’re great with attention to detail and produce high-quality work.

- You grasp complex issues and establish solutions to address them.

- You thrive in situations that require negotiation and influence.

- You’re able to effectively manage a sizable and demanding workload.

- You’re a self-starter who is always proactive and responsive.

- You consistently meet deadlines and are dependable.

- You excel in servicing clients and putting their needs first.

- You have a positive attitude and an unrelenting work ethic.

This is an opportunity to join an insurance brokerage company that was recognized by US Business Insurance as having the number one Best Workplace Culture in the country.

- Play a vital role in the growth and perpetuation of a company.

- Become owners of a company that has developed a strong reputation in the industry.

We recognize that you’ll come to us with insurance knowledge. Yet we’ll make sure you get all the training, resources and support needed to learn the Cavignac Way. All of which will put you in the best position to excel as a Risk Advisor and achieve your objectives throughout your career.

The following details a general list of Duties, Qualifications and Abilities for this position.

The primary duties of the Risk Advisor consist of:

- Create your Personal Excellence Plan with the Sales Manager and President.

- Identify, develop and nurture relationships with prospects and centers of influence.

- Leverage a system to maintain contact and add value to prospects, centers of influence and clients on a consistent basis.

- Deliver sales presentations to prospects and clients on new and renewal business.

- Adhere to Cavignac’s TotalRISK Approach sales process.

- Provide risk management/loss prevention advice to prospects and clients.

- Cross-sell the agency’s services.

- Ask for referrals from centers of influence and clients to generate new business.

- Participate in team sales situations with other Risk Advisors and support personnel.

- Proactively work on upcoming renewals to ensure services are completed in an accurate and timely manner.

- Assist in marketing accounts when having key relationships and/or product expertise.

- Review proposals prior to meeting with clients.

- Work with the team to design insurance plans and recommend coverages to clients.

- Document all material conversations in Epic with insureds and/or carriers regarding coverages and exposures.

- Maintain accurate client information while adhering to company SOPs.

- Resolve claim, billing and late premium problems while accurately documenting in Epic with service records (when required).

- Work with the team to ensure coverage adequacy and identify Cavignac resources needed to service client needs.

- Develop a profitable book of business for the agency and carriers.

- Execute the Personal Excellence Plan to ensure that the objectives are achieved.

- Take initiative for learning and improving technical and sales skills regularly.

- Attend and participate in sales meetings.

- Manage workload and relationships while consistently hitting monthly sales goals.

- Attend client related professional association events along with insurance association and company events.

- Understand and comply with agency SOPs, Customer Service Standards, and the Employee Handbook.

- Deliver presentations for professional associations, community events, partner webinars, etc.

- Join and participate in non-profit organizations throughout the community and sit on at least one Community Board.

- Maintain positive relationships with Cavignac employees and partners.

- Must hold and maintain current California Life and Health License.

- 4+ years experience as an Employee Benefits Risk Advisor (Preferred).

- Proven success record in achieving sales objectives and numbers.

- Attained a Bachelor’s Degree (Preferred).

Abilities

- You lead through your actions and embrace your responsibilities.

- You’re a continuous learner who is always seeking to improve.

- You put the team first and create ways to make your peers better.

- You deliver an exceptional level of service to those you work with.

- You have strong interpersonal skills and thrive in a team environment.

- You’re an effective communicator; both written and verbal.

- You’re great with attention to detail and produce high-quality work.

- You grasp complex issues and establish solutions to address them.

- You thrive in situations that require negotiation and influence.

- You’re able to effectively manage a sizable and demanding workload.

- You’re a self-starter who is always proactive and responsive.

- You consistently meet deadlines and are dependable.

- You excel in servicing clients and putting their needs first.

- You have a positive attitude and an unrelenting work ethic.